According to the latest data provided by the Spanish Factoring Association, 266,652 million euros were financed through Factoring and Confirming last year, a slightly lower amount than in the previous year, 2023 , and representing a slight year-on-year decrease of 1.38%.

The decline in international factoring is the main reason for the slight drop in the sector compared to 2023: it has suffered a year-on-year decrease of 10% (standing at 33,400 million euros), caused by the weak growth of the countries that are geographically close to Spain and which are the destination of 70% of Spanish exports. The geopolitical situation and external conflicts may have had an impact on these markets, which are traditionally important importers of Spanish products.

Slightly lower credit demand and the interest rate situation, where short-term (one- and three-month) rates have fluctuated in bands close to 10% higher than for one-year rates, have contributed to the decline.

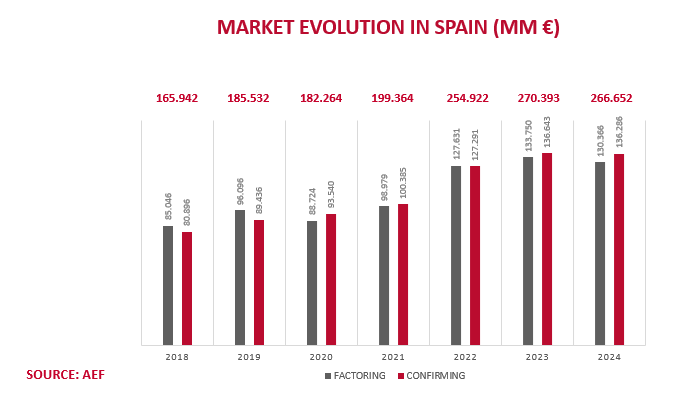

However, the cumulative average growth of Factoring and Confirming in our country is 8.2% over the last six years. It should be borne in mind that this slight drop in 2024 comes after two years of significant growth: in 2023, the volume of invoice assignment increased by 6.07 %, and in 2022, it increased by no less than 27.87%.. The AEF indicates that 2024 has been a year of consolidation and recalls that Spain is the fifth country in the volume of assignments in Europe.

Here we can see the evolution of the industry in our country during the last seven years:

A fact that evidences the important penetration that Factoring and Confirming products have in our economy is the total amount of credits managed by the entities associated to the AEF, which in 2024 exceeded 393 billion euros, a figure that represents almost 25% of the Spanish GDP.

The ratio between the two major groups of services and products in the sector remains, as in previous years, at very similar levels: Factoring accounted for 49% of the total and Confirming for 51% (compared with 50%/50% the previous year). With regard to the latter product, it is important to note that the volume of payment orders managed continued to grow for yet another year, reaching 262 billion euros (77% more than six years ago). It should be recalled that Confirming originated in Spain and the service is currently particularly well developed in the country (other markets in our environment offer the same or similar services, with a different name, which are not so widely used).

Inblock Project

On the other hand, the AEF has assured that its Inblock platform (which will use Blockchain technology to simplify processes and reduce the documentary burden currently required of companies) is already in the testing phase and will become operational in the second half of the year.

According to the association, this initiative “will represent a step forward for the sector in relation to the control and validation systems for purchased credits, seeking to be more efficient in the processes, mitigating operational risks and, above all, boosting and expanding the use of these trade finance services in those smaller business groups and segments, where these trade finance tools have the greatest capacity for growth: in SMEs”.