On May 11 and 12, the Spanish Factoring Association held its XLI Assembly at the Westin hotel in Valencia. An important meeting of the commercial financing sector in our country, once again sponsored by Alvantia. (more…)

The importance of operational risk mitigation

Undoubtedly, operational risk is a matter of concern to financial institutions. However, on many occasions they focus their resources on important marketing and sales processes, underestimating the operational ones. And the truth is that we should consider operational processes as front line, especially within the working capital and supply chain management industry. (more…)

Alvantia participates in the Supply Chain Finance Summit 2023

On January 24th and 25th, Alvantia participated in the Supply Chain Finance Summit 2023, a meeting that was held at the Cecabank offices in Madrid and brought together the main players in the Confirming sector at an international level.

The event, organized by BCR Publishing, in collaboration with FCI and the Spanish Factoring Association (AEF), had an interesting program focused on the latest trends in the SCF industry. (more…)

Main challenges and opportunities of Factoring in Peru

Article published on TRF News

The factoring industry took off in Peru, in practical terms, in 2016. It then began to develop strongly in this country that is suffering from a permanent political crisis (it has had five presidents in less than five years), and despite this, it is one of the most successful and stable economies in Latin America. (more…)

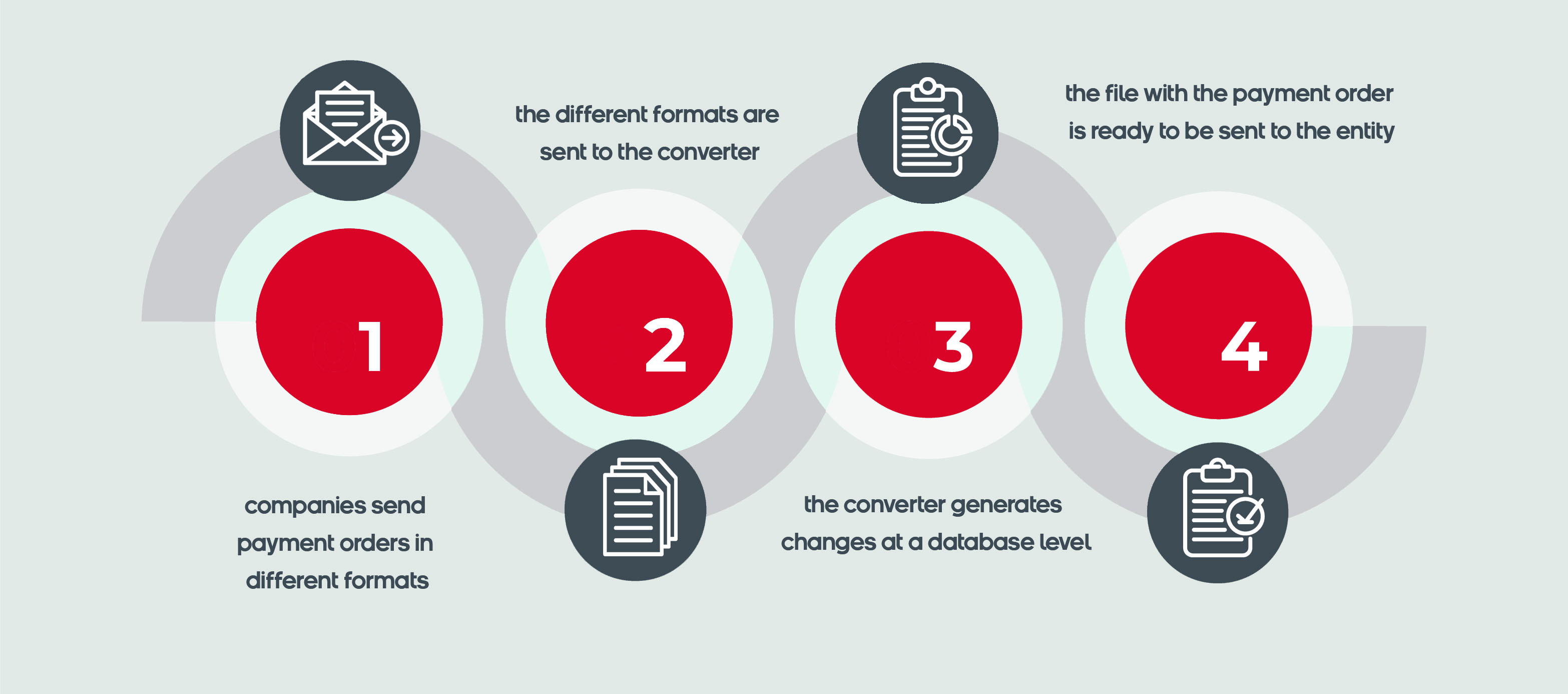

Alvantia, simplifying Confirming Payment Orders between companies and entities

Within the Confirming activity, the management of sending remittances is a process that, a priori, can be trivial. However, this is a key phase in which different business areas of the entity are involved (such as Operations, Sales and Technology) and in which it is essential to successfully address one of its main problems: the management of the large variety of formats that have emerged over the years. (more…)

The unstoppable evolution of Factoring in Colombia

A few years ago, Factoring in Colombia was a non regulated activity and its reputation was not very good (in some cases, it was even related with a lack of financial health). These conditions made the development of this product very difficult. In fact, as it is said in Actualícese, less than a 5% of SMEs accesed to this financial tool in 2019. (more…)

Syndication applied to Confirming programs

Confirming or Supplier Financing programs known as Supply Chain Finance (SCF) have proven to be a good tool for managing payments from companies as well as providing financing for their SME suppliers. Since its origin, the product has undergone many variations, improvements, and advances in the market, all of which have served to demonstrate how important it has become to its users as it continues to add value to them in particular and the market in general.

Data management in trade finance: do we really make the most of the opportunities provided by technology?

There is a key aspect managing the financing of trade credit, in general, and reverse factoring, in particular, which is not always well designed and used, from a trade, operational and risk point of view, in contrast to other financing arrangements: big data.

(more…)How trade finance helps companies during Coronavirus crisis?

From this forum of opinion and ideas, that is the Alvantia Blog, we would like to put forward our humble vision of the situation in which we are currently embroiled, and will continue to experience over the next few days and weeks. We will look at this in a strictly economic and financial context and particularly from the point of view of a simple analysis and forecast of what may happen in the coming months, specifically, the liquidity that the network of SMEs and the self-employed will need.

(more…)© 2025 ALVANTIA