Within the Confirming activity, the management of sending remittances is a process that, a priori, can be trivial. However, this is a key phase in which different business areas of the entity are involved (such as Operations, Sales and Technology) and in which it is essential to successfully address one of its main problems: the management of the large variety of formats that have emerged over the years.

We must bear in mind that, when the Confirming product was born, each entity defined its own format, in a much more varied market than the current one with more than 50 operators including banks, savings banks and other financial entities. Later, different versions of each format emerged due to different evolutions of the product (Euro, International Confirming, SEPA, etc.), as well as personalized variations with the specifications of each client, so that, over time, the number of formats was increasingly high.

Faced with this scenario, most of the entities that attracted clients that until now had been managed by their competitors, adopted two different positions: admit only the most common formats (which often meant not attracting certain clients) or carry out individual converters for each new format. In the long run, this last strategy was revealed as a growing annual cost for the entities: the number of converters was increasing and they not only had to be created, but also maintained.

With the aim of eliminating this problem and simplifying communication between companies and financial institutions, in 2018 the Spanish Factoring Association presented the “Formato Único de Confirming”. However, taking into account that approximately 50,000 companies had already operated up to that moment with a wide variety of formats, today and on many occasions, sending payment orders continues to be a challenge.

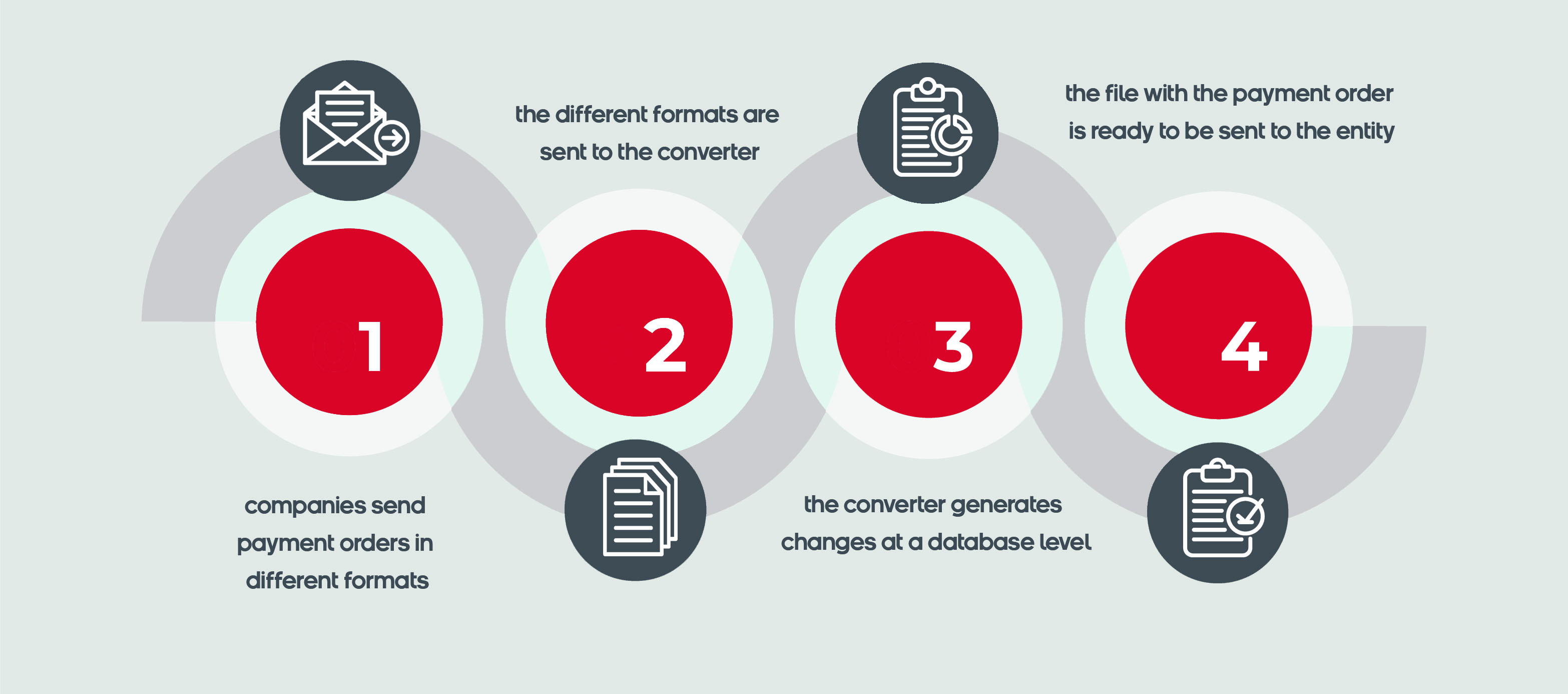

To simplify the process, Alvantia has developed a completely autonomous software component: it is a universal format converter that allows us to obtain base files in “formato único” or in any other valid format for the entity/ies, starting from the requirements of each company.

Thanks to the fact that all the changes are made at the database level, there is no need to develop a program for each conversion, but once the client’s requirements about its expected base format are clear, it is possible to obtain conversion and deliver it at short notice.

For this development, a very innovative architecture oriented to microservices has been used, decoupling the functionality in atomic Rest services. The most powerful tools currently on the market have been used, such as J2EE and the Spring framework, and it is deployed using Docker containers on a Docker Swarm cluster.

This architecture has among its main characteristics:

-High availability

-Scalability

-Reusability

-Ease of integration with third parties

It is equipped with a security system for communications with the API based on OAuth2. In addition, it has a front end based on Angular 11 that allows you to create hybrid applications in Javascript, HTML5 and CSS3, which allows complete adaptation to the environment.

Customer support service

The remittance converter complements the customer support service that Alvantia offers to the market.

During the conversion period and thanks to the use of an agile methodology, we prioritize interactions with people and make sure the product works perfectly. To do this, we maintain a close collaboration with the client, whom we accompany during the onboarding process, checking the file used to send payment orders and responding to its conversion to the most suitable base file.

In this accompaniment service we can distinguish different phases:

Presentation of requirements: During this period, Alvantia focuses on knowing the format(s) used by the client to manage their payment orders, in order to be able to evaluate the necessary conversions and select the most appropriate base format.

Elaboration of the conversion: This period will focus on creating the best option for the client. A close relationship will be maintained, evaluating the different payment methods it maintains with its suppliers through banking entities.

Test period: Alvantia will continue to maintain a close relationship with its client during this period, in which it will be guided by offering a set of tests focused on the formats with which it works and will be shown its conversion in the selected base format. The customer will be able to see at all times where the data of their payment orders are reflected in the new format.

Support period: Once the conversion to the selected base format is completed, the client will have a stipulated period, in which assistance will be provided on the converter, either to clarify doubts about its use or to solve possible incidents after its implementation.

Thanks to this complete service, Alvantia optimizes the on boarding of new Confirming clients, reducing times and improving client satisfaction.