(Article published in TRF News -July 2024-)

Introduction

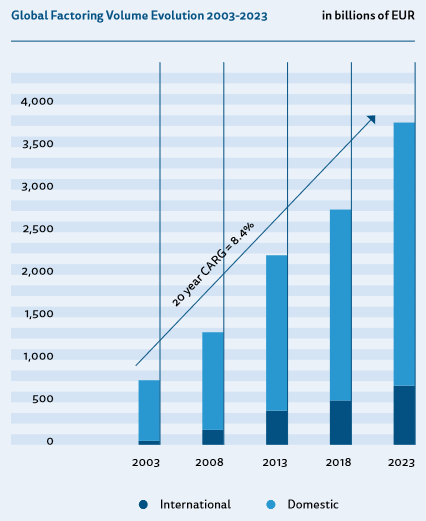

According to the latest data from Factors Chain International the global Factoring industry grew by 3.6% in 2023. In this graph we can see the unstoppable growth of the sector during the last 20 years:

Image: FCI

With regard to market distribution in the different continents, Europe has always been the leader and currently accounts for almost 70% of total turnover.

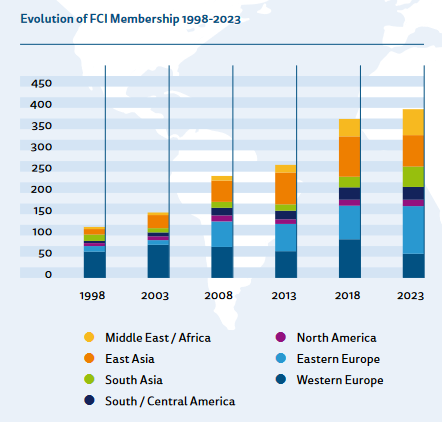

But what is happening in other parts of the world, such as Latin America? This image shows the geographical distribution of the industry from 1998 to 2023:

Image: FCI

In 2023, the American region accounted for 6% of global factoring volume. But we should note that while North America suffered a 10.7% decline in turnover, Central and South America achieved a 4.3% increase to EUR 92.8 billion.

As we can see, Latin America has maintained a positive evolution. However, it still has a long way to go to reach the figures of other markets. Furthermore, within the Latin American market, we find different realities in the different countries.

Chile is undoubtedly the country where factoring enjoys the greatest development and maturity in the region: the industry was born in the mid-1980s and factoring operations already represent 13% of its economy’s GDP, according to the Chilean Factoring Association (ACHEF).

In other countries such as Colombia and Peru, factoring is growing rapidly and national associations have developed in recent years to promote this activity.

In addition, at the regional level, there is the Latin American Factoring Federation comprising Peru, Colombia, Mexico and Chile.

In other Latin American countries, factoring began to develop later, and although there is no official registry of the industry’s operations, it continues to evolve quite positively. This is the case of Nicaragua.

Nicaragua: overview

With an area of 130,373 square kilometers, Nicaragua is the largest country in Central America.

According to the World Bank, it has great development potential, but remains one of the poorest countries in the region.

In 2023, GDP grew by 4.3%, driven by sectors such as electricity, mining, commerce, construction, finance, transportation, and communications. Consumption and investment also increased.

In December 2023, the Monthly Index of Economic Activity (IMAE) showed a year-on-year increase of 5.5 percent. GDP growth is expected to be 3.7 percent in 2024 and to stabilize at 3.5 percent in the medium term.

Small and medium-sized companies make up more than 90% of Nicaraguan companies and, according to the latest World Bank report on Innovation, “although the creation of companies in the country is high, the companies that survive grow at a much lower rate than their peers in other regions and middle-income companies. One of the reasons for this is the lack of financing in the face of the urgency to upgrade technology, improve quality and adopt new technologies. Although the sector is thriving, in Nicaragua it is vital to improve the training of its owners and make MSMEs more competitive due to their role in the economy.” In this sense, tools such as Factoring and Confirming play a very important role.

Beginning of Factoring activity in Nicaragua

In Nicaragua, the “Factoring” activity (a term commonly used in many countries in the Latin American region to refer to Factoring) began to develop at the end of the 1990s. Afinsa Factoring was one of the pioneering institutions in this activity. Its Managing Director, Silvio Conradoexplains that in the 1990s, with the liberation of the financial sector (which until then had been controlled by the state) and with the creation of banks, other non-traditional financial services companies also appeared, such as brokerage firms, bonded warehouses, microfinance and factoring companies, among others.

Afinsa began in 1998, initially providing economic and financial advice to institutional clients.

“We quickly realized that the main common factor among our clients was the need to obtain more working capital, as there were many companies at that time that were undercapitalized or in the growth stage. We founded the second private factoring company in Nicaragua not related to any banking group,” says Conrado, who acknowledges that at that time “there was a lot of ignorance and erroneous myths about how the service works.”

Another of the pioneering companies in the sector, Credifactor, was selected by the Inter-American Development Bank (IDB) for the Inter-American Development Bank

(IDB) in 2005 for its financing and technical cooperation project “Boosting the Growth of the Factoring Industry in Nicaragua” through which it granted financing to the company, as well as helping to promote the laws we will discuss later. As stated in the IDB project, the objective of the project was to “increase the competitiveness of Nicaraguan SMEs by improving their access to financing services that meet their particular needs.” And to that end, it was decided to “support the growth of a financial intermediary that serves the SME market by granting it a loan that will enable the company to triple the number of clients it serves. ”

At that time, factoring activity in Nicaragua was beginning to increase as companies began to see it as a good source of recurrent short-term financing, rather than simply a “last resort” mechanism to shore up temporary liquidity problems or for companies experiencing financial difficulties.

However, according to the IDB, only 0.57% of private credit offered in Nicaragua in 2005 was granted through factoring, compared to 4.4% in Costa Rica and 3.1% in Guatemala. At that time, factoring was used almost exclusively by small companies with less than US$500,000 in annual revenues.

In the following years, a regulatory framework for the factoring sector was developed and banks became interested in offering the service.

Legal framework

Factoring activities in Nicaragua are regulated by the Foreign Exchange Invoice Lawdeveloped to guarantee with legal certainty the immediate access to liquidity in the commercial sector (with emphasis on micro, small and medium-size companies) and the Factoring Lawwhich develops legal provisions tending to establish the basic content of the factoring contract, regulates the commercial and financial relationship between the contracting parties and establishes the minimum requirements to be met by the companies or financial companies engaged in this type of business.

Both regulations were approved in November 2010 with the main objective of promoting and strengthening the growth of Factoring in Nicaragua, providing the country with a legal instrument that allows invoices to be an enforceable title.

The industry today

Despite the advantages of having access to short-term working capital, many Nicaraguan companies are still unaware of the existence of these services or do not know what they really consist of. Nevertheless, the activity has been gradually increasing in the country.

Currently in Nicaragua, the main banks already offer these products. Banpro (which is the largest financial institution in the country and has recently merged with BDF) is one of those that has them in its portfolio. Its Vice Manager of Factoring, Nidia Vallecilloconfirms that all factoring operations carried out are with recourse and, with respect to Confirming, she clarifies that “the financial expense is assumed 100% by the supplier and interest is charged proportionally to the days that the supplier pays in advance. It is based on an annual interest rate. The credit line is opened directly to the client (payer). Credit lines are not opened to each supplier (in this case Confirming would be without recourse to the supplier).”

Vallecillo highlights the benefits that these products can bring to Nicaraguan companies: “especially to small and medium-sized companies, it helps them grow, because they are provided with capital to continue servicing new clients or new orders. They don’t have to wait up to 120 days for a credit term. They turn their money around faster.”

For his part, Óscar Granja General Manager of Factoring S.A. and SERFIN LATAM also believes that Factoring and Confirming are really important for Nicaraguan companies, since “the cash cycle is shortened and provides greater liquidity to the parties”. Regarding Confirming (a service they have been offering in the company for 8 years now), Granja indicates that they have a “flexible system: the cost can be assumed by the supplier or the client; this depends on the client’s bargaining power, but the system is prepared for both options.”

Conclusions

Although factoring and confirming products began to be offered in Nicaragua exclusively by finance companies and did not enjoy the best reputation among small and medium-size entrepreneurs at the time, this has been changing and they are now better valued products in the business sector and the country’s main banking institutions have them in their portfolios.

However, there is still a lot of work to be done.

As Silvio Conrado points out, “after 26 years of service, our greatest challenge is to evangelize and educate about the use of these services. There is a great lack of knowledge about Factoring and Confirming, especially Confirming. When we visit prospective clients, many times they tell us that they did not know that their accounts receivable can be discounted”.

We see therefore that the market still has a lot of potential for growth and its positive evolution would be very relevant for the future of Nicaragua, where small and medium-sized enterprises are recognized as the backbone of the country’s economy.

They contribute significantly to the national GDP and are responsible for a large part of employment. Factoring can often be the only financing tool for many companies in countries such as Nicaragua, as they do not need to present collateral and may have a short credit history. Credit decisions are based on debtor risk, not borrower risk.

In addition, factoring can be especially important in financial systems with weak commercial laws, contract enforcement and bankruptcy systems. Because it is a purchase and sale transaction, in which the factoring company purchases the borrower’s accounts receivable, the rights of creditors and the enforcement of the loan contract are not as critical to factoring companies as they would be in, for example, normal bank credit transactions. If a borrower goes bankrupt, its factored receivables would not be distributed to its creditors as part of a bankruptcy settlement because they would be owned by the factor.

We therefore hope that the Factoring industry will continue to develop in Nicaragua and become the financial lifeline that SMEs, the engine of the country’s economy, need so much.

Roberto Gutiérrez

CEO Alvantia